Use your funds for any purpose

Get your funds within 24 hours

Get a loan with no monthly or exit fees

Protect your credit score with a risk-free preapproval

Lorem ipsum dolor sit amet,consectetur adipiscing elit.

Are you struggling to get approved? Not sure how to get started? Cant get the right help or advice?

Speak to a loan expert that can give you the right advice and present you with multiple loan options

A marketplace of people and ignition loans off working together to deliver your then best possible deal.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

A quick and casy. 100% online application. No painting , No paper ,No fase.

Dont go to the big banks and overpay!

we use a range of nonbank lenders that personalise a rate specific to your profile and credit score. This means you are able to get a lower rate than the big 4 banks!

Competition Rate

Click on ‘Unlock my rate’ to get started

We will call you to discuss the best way to get you approved for your loan

Once approved you can shop for a car with confidence. We will found your purchase within 24 hours

Click on ‘Unlock my rate’ to get started

We will call you to discuss the best way to get you approved for your loan

Once approved you can shop for a car with confidemce. We will found your purchase within 24 hoursd

To qualify for a loan, you must be able to demonstrate a consistent income, a good credit history, and ability to repay your current debt obligations. Your credit score is taken into account to determine your starting rate, and a minimum of 500 in most cases is required to get started

There are a range of uses that are acceptable under a personal loan. You are able to buy an asset like a car, bike, or boat, or use it reduce your credit commitments. You can even use it for personal purchases like computers, household items, furniture, bed, and even finance experiences like overseas holidays or weddings!

A secured loan is when the financier will secure your loan against an asset, say like your house or car. This is not so common amongst lenders anymore as its an outdate practice. In most cases, your loan will be unsecured and doesn’t require you to put up an collateral of any kind.

There are several things that will go into deciding your starting rate. The first thing that every lender will look at is your credit score. The higher your score is, the lower your starting rate may be. They will also consider how long a term you select, your overall profile, and how much you look to borrow. All these factors go into deciding your interest rate.

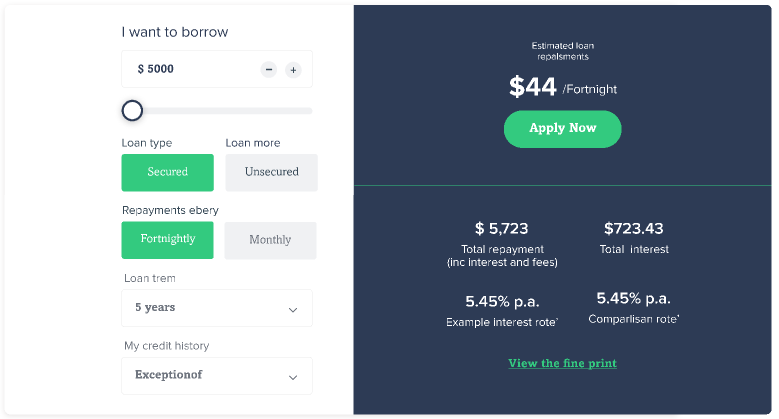

Wondering howa personal loan will fit into your budget? Our easy personal loan calculator can help you to calculate what your repayments will be.