We have low doc and no doc options for ABN holders with tricky circumstances

Range of commercial lending options

Low doc & no doc options available

Understanding credit team that works to uncover solutions

We have access to over 15 car loan lenders, from banks to non-bank lenders

Learn more

Connect with lenders that offer discounted payout fees

Learn more

We have 6 or 7 year loan terms to assist with budgeting Learn more

Deal with 1 local expert through the journey. No overseas call centres

Learn more

secure funding without providing a tax return.

Learn more

Automatic approvals for customers replacing current car loans*

Learn more

Provide bank or BAS statements to prove your income

Learn more

Refinance your balloon payment, or restructure your current loan

Learn more

Click on ‘Request my rate’ to get started

We will call you to discuss the best way to get you approved for your loan

Once approved you can shop for a car with confidence. We will fund your purchase within 24 hours

A business! Ideally you need to be running your business for more than 12 months, but we have product options for new businesses as well.

We can help you get any type of car that you will use for your business. This includes passanger cars, utes, vans, and even trucks.

Not necessarily! We are able to get creative with our approval process, so while we prefer tax returns and accountant prepared financials we can also use BAS and Bank Statements for assessment, and if you have a 10% deposit we may even be able to approve you without any financial proof at all.

No! We assist anyone with an ABN or even employees with car allowances who use their vehicles for business purposes. we can assist you if you are a subcontractor, sole trader, partnership, or a PTY LTD company.

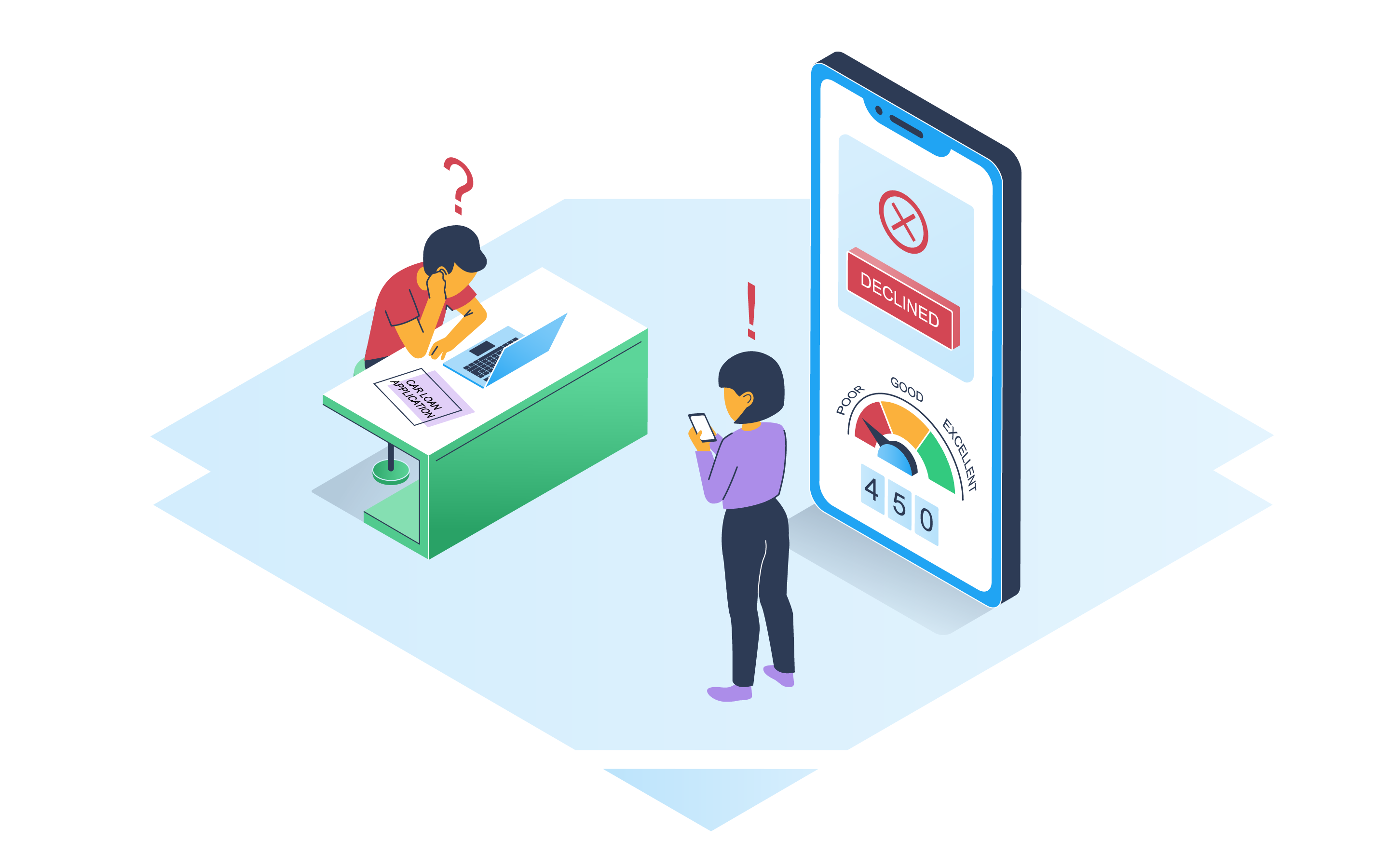

If you want to qualify for a low interest rate, yes. There are bad credit options available for customers with credit issues.